The bill provides funds through FY2031 for the CMS to implement the rebate programs. Manufacturers that fail to comply are subject to civil penalties. In addition, the bill requires drug manufacturers to issue rebates to the CMS for brand-name drugs without generic equivalents under Medicare that cost $100 or more per year per individual and for which prices increase faster than inflation. Part 2-Prescription Drug Inflation Rebates The bill provides funds for FY2022 for the CMS to implement this program. Drug manufacturers that fail to comply with negotiation requirements are subject to civil penalties and excise taxes. The CMS must negotiate the prices of 10 drugs in 2026, 15 drugs in 20, and 20 drugs in 2029 and each year thereafter. Specifically, the CMS must negotiate maximum prices for brand-name drugs that do not have other generic equivalents and that account for the greatest Medicare spending. The bill requires the Centers for Medicare & Medicaid Services (CMS) to negotiate the prices of certain prescription drugs under Medicare beginning in 2026. Part 1-Lowering Prices Through Drug Price Negotiation Subtitle B-Prescription Drug Pricing Reform

It also provides additional funding for the Department of the Treasury Inspector General for Tax Administration, the Office of Tax Policy, the Tax Court, and Treasury departmental offices.

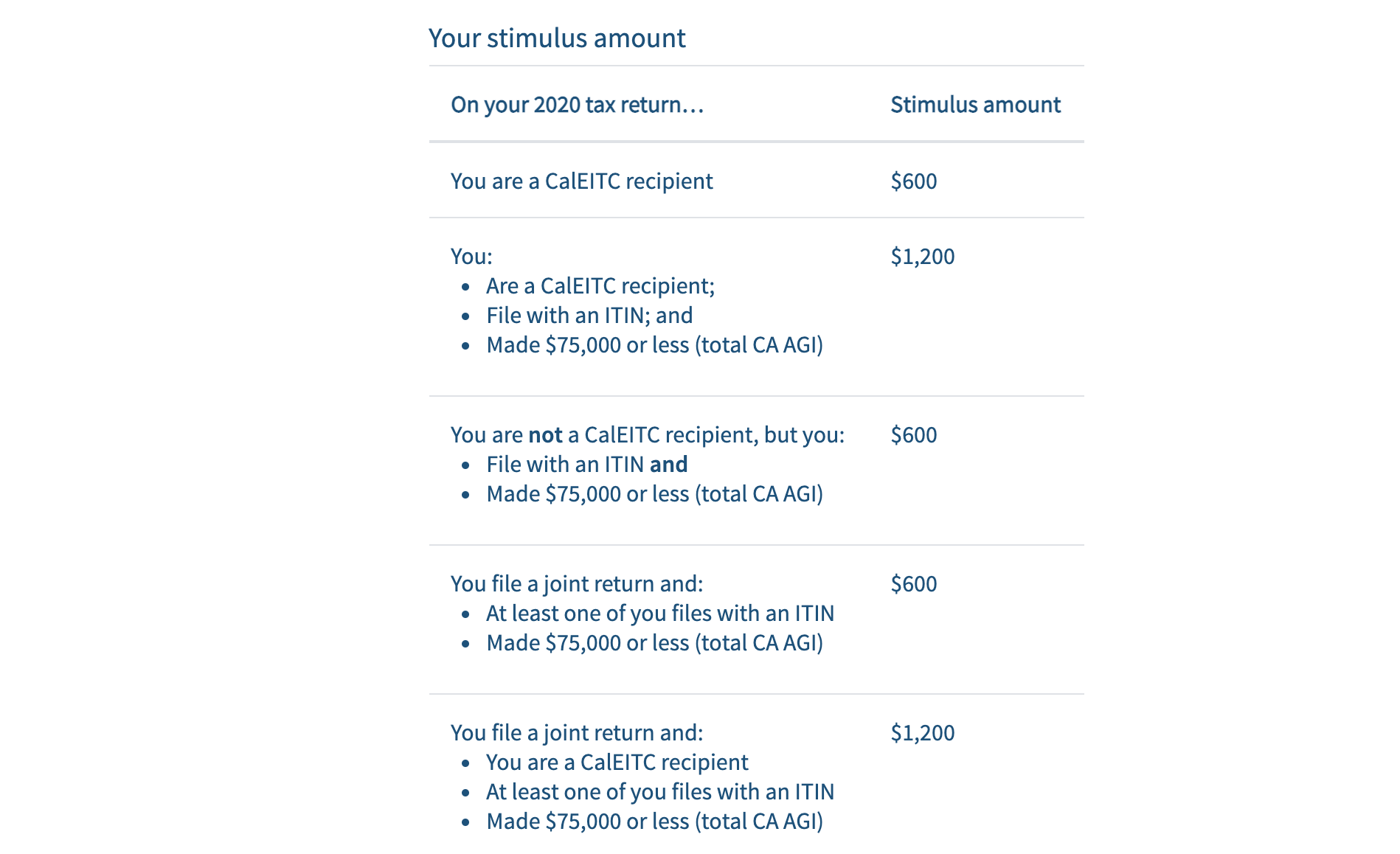

#California stimulus free

The bill provides additional funding for the Internal Revenue Service for taxpayer services and enforcement, including for operations support, business systems modernization, and the development of a free direct e-file tax return system. Part 3-Funding the Internal Revenue Service and Improving Taxpayer Compliance The bill imposes a 1% excise tax on the fair market value of stock repurchased by a domestic corporation after 2022, with certain exceptions. Part 2-Excise Tax on Repurchase of Corporate Stock The tax is effective in taxable years beginning after December 31, 2022. This bill imposes an alternative minimum tax of 15% of the average annual adjusted financial statement income of domestic corporations (excluding Subchapter S corporations, regulated investment companies, and real estate investment trusts) that exceeds $1 billion over a specified 3-year period.

0 kommentar(er)

0 kommentar(er)